Other Archives - Page 2 of 2 - EA Assist

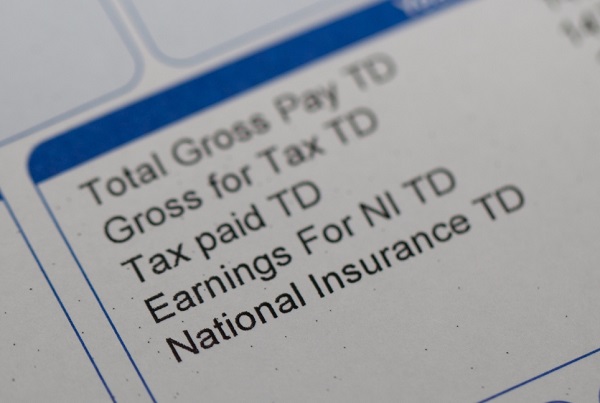

EA Assist Ltd offers payroll and bookkeeping services throughout Norfolk and Suffolk. We provide a complete payroll service including CIS, RTI and Auto-enrolment along with Bookkeeping, VAT and Cloud accounting services.

payroll, bookkeeping, CIS, Auto-enrolment, work-place pensions, payroll diss, payroll norwich, payroll thetford, bookkeeping diss, bookkeeping thetford, debt collection, xero, VAT, suffolk, norfolk,

-1

archive,paged,category,category-uncategorised,category-1,paged-2,category-paged-2,bridge-core-3.0.9,qode-page-transition-enabled,ajax_fade,page_not_loaded,,qode-child-theme-ver-1.0.0,qode-theme-ver-29.7,qode-theme-bridge,qode_header_in_grid,wpb-js-composer js-comp-ver-6.13.0,vc_responsive